Bangladesh Commerce Bank Limited is known as a commercial bank. Like all commercial banks BCBL’s core business is obtaining deposit and providing loans. It is a financial institution providing services for businesses, organizations and individuals. Service includes offering different types of deposit account such as current deposit accounts, saving deposit accounts and other scheme accounts as well as giving out loans to businesses and individuals.

BCB make its profit by taking small, short-term, relatively liquid deposits and transforming these into small, medium, larger loans for short, medium and longer maturity loans. These processes of asset transformation generate net income for BCB. BCB also does investment banking though it is not considered its main business area.

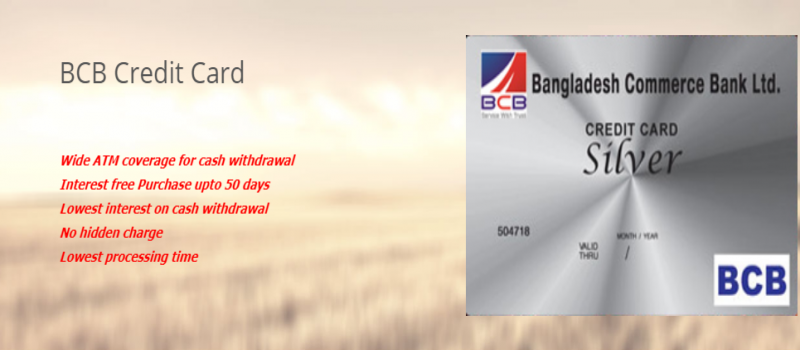

However, BCB is primarily engaged in deposit and lending activities to private and corporate clients in wholesale and retail banking. Other services typically include credit cards, mobile banking, custodial service and guarantees, cash management and settlement as well as trade finance.

Retail Banking

Loans & Advances

Debit Card

Mobile Banking(Sure Cash)

Corporate Banking

Export Financing

Syndicate Financing

SME Product

NRB Services